This plan permits business owner to increase funding while retaining using the possessions that are needed in the business. A sale-leaseback can supply the development of considerable resource of funds that can be utilized for a range of purposes. This consists of repaying a specific loan provider, as working capital, to buy-back capital stock, buying out a partner, or updating properties, etc.

In sale-leaseback financing, is completed by sharing the title of the property, at an agreed upon value, to a banks in exchange for a lump-sum settlement. Business owner after that makes lease settlements to the finance company in exchange for the cash money insertion.

Advantages. Numerous firms can benefit from this kind of purchase. If you do not get traditional bank funding or wish to protect your existing financial institution credit limit, sale lease-backs can be made use of to finance growth, restructure troubled financials, offer tax benefits as well as improve balance sheets.

This is a strategy to raise cash money. All entrepreneur understand that money is king. From a tax viewpoint, sale lease-back offers the possibility to structure the deal as a taxed sale, which can be countered by web operating losses that, might or else run out if unused. It might likewise use distinct financial or tax benefits for business that have been not able to use web operating loss carry forwards for government earnings tax obligation functions.

Given that lease settlements are not considered choice things, firms that remain in a Different Minimum Tax (AMT) scenario may benefit as well. This write-up ought to not be thought about tax obligation recommendations. Local business owner need to always look for specialist tax obligation advice from their Certified Public Accountant or Tax Lawyer prior to making tax choices based on a sale lease-back transaction.

Company Qualifiers: If you have been in business for a minimum of 18 months, have a personal FICO Rating of 620+, own the devices outright, no open tax liens, no open insolvencies and also have financial statements that show that you can service the lease settlements, you are a viable candidate for sale-leaseback financing.

Each money firm has its own minimal deal dimension as well as financing criteria, so it is best to compare terms from each. Note: Restaurant owners generally will have to be in business 2 years, with an individual FICO score of 650+ prior to the financial institution will certainly think about a sale lease-back purchase.

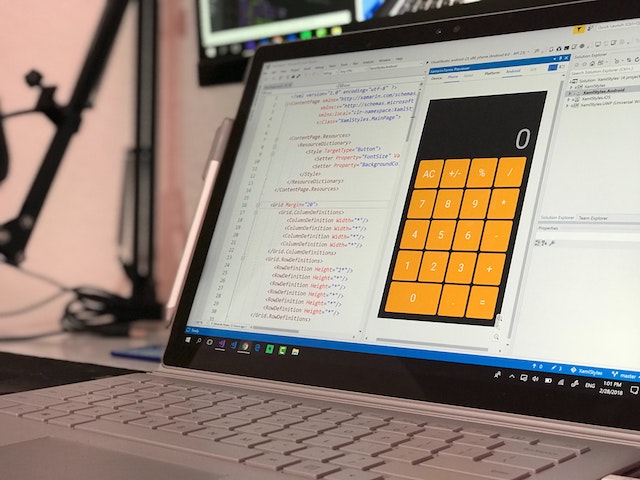

Qualified Devices: A lot of long lasting devices is qualified for sale-leaseback financing. Some instances: All types of IT devices, computer systems, laptop computers, servers, network buttons, routers, telephone systems, photo copiers, faxes, machinery, dry-cleaning equipment, telecommunications tools, work area terminals, car fixing devices, diagnostic devices, building tools, gym tools, and all fashion of clinical tools … simply to provide you a concept.

Video gaming as well as beauty salon devices normally are not eligible for sale-leaseback transactions. Some finance companies focus on particular kinds of equipment. Others will consider a variety of devices. Find a good Personal Loan Money Lender in Singapore by going to this website.

Application Refine: It is unexpected simple contrasted to other forms of financing. Call the financing company for their 1 to 2 web page application. Supply a listing of the equipment that you desire considered. (Depending on the age of the devices, there might not be a need for an evaluation of the residual worth). Fax the application to the financing business. Anticipate a reaction in 24-48 hours. If you authorize their proposition, you can have funds in-hand in 10-14 days.

It ought to be noted that you are offering a firm property to a financing company and afterwards renting it back. As such, the application/approval procedure is much more uncomplicated than the regular debt-financing deal and consequently a much faster funding procedure.

In recap: If you want a cash infusion for your company, very own tools outright as well as are willing to offer equipment to a specialized financing company, however preserve it for use in your organization, then sale lease-back funding is a funding device that is offered to business proprietor.